Vietnam’s fintech boom: What’s in it for Australian business

With a young, upwardly- mobile population, ongoing economic growth, and over 100 million tech savvy consumers, Vietnam’s banking and financial system is undergoing rapid transformation.

Vietnam is poised to emerge as one of Southeast Asia's most competitive fintech markets. Buoyed by an influx of venture capital, local-start ups such as MoMo now jostle with regional giants like Grab and Sea for primacy on consumers’ smart phones. This emerging fintech market not only spans eWallets, mobile payments and a vast network of backend technologies, but is redefining banking, insurance and other financial services.

How can Australian companies be part of this emerging fintech sector in Vietnam? What skills and insights are needed to collaborate on and share technologies and innovation?

With its booming fintech sector and low uptake of traditional banking, Vietnam is ‘leapfrogging’ technologies, with many consumers going straight to eWallets and mobile payments, such as local startup MoMo.

In partnership with the Department of Industry, Science, Energy and Resources (DISER) and Austrade, Asialink Business is excited to commence a new capability development program, aimed at building awareness and positioning Australian business to engage in Vietnam’s fintech sector. The initiative will include a high-profile launch event to raise awareness on the fintech opportunity, as well as tailored capability development sessions targeted at both board executives and business leaders, to help prepare organisations to navigate these opportunities.

The program will complement and support the Australia Vietnam Enhanced Economic Engagement Strategy. This Strategy, due for completion in late 2021, will solidify Australia and Vietnam’s “shared commitment to trade and investment, liberalisation and economic connectivity, and help both countries take advantage of emerging market opportunities.”

Why Vietnam, Why Now for Australian Fintech?

Vietnam has the fastest growing middle class in Southeast Asia, a COVID-resilient GDP growth rate (2.9% in 2020), and a young population that readily embraces new technology.

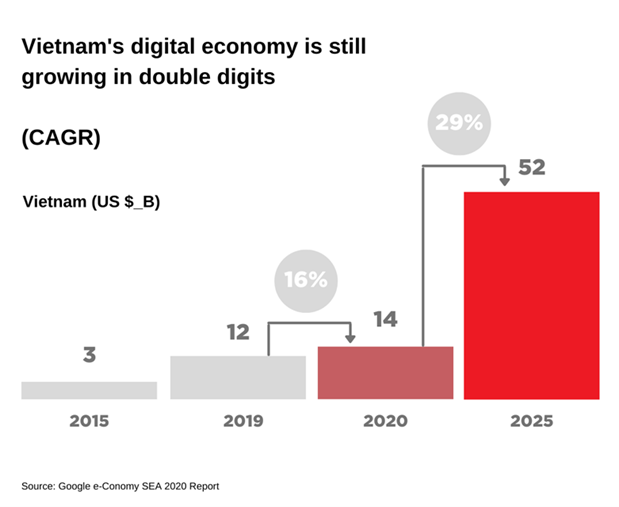

Whilst the country has suffered from COVID-19, the pandemic has also accelerated the uptake of digital services. In 2020, more consumers moved online and tried new digital services for the first time (for example, in healthtech, edtech and fintech), helping to fuel growth of 29% in the country’s digital economy.

.png)

Whilst this was one of the highest growth rates in the region, this rapid uptake in digital consumption is part of a Southeast Asian-wide trend: The region added 40 million new internet users in 2020 alone. According to the e-Conomy report by Google, more than one in three digital service users in Southeast Asia started using a new service (such as a healthtech, edtech or fintech service) as a result of the pandemic.

.png)

Fintech has shown particular promise due to the low uptake of traditional banking and insurance services. Around 70% of the Vietnamese adult population do not have a bank account, the highest within the ASEAN region. Vietnamese consumers are leapfrogging traditional banking offerings, going straight to mobile payment platforms.

This is being driven by consumer digital readiness, increasing domestic spending power, and strong government support to consolidate the regulatory framework. Around 97% of Vietnam’s internet users primarily go online via their smartphones (Hootsuite/We Are Social, 2021). The Vietnamese Government's National Digital Transformation Program towards 2025, vision to 2030 prioritises digitisation, helping to spur fintech innovation, with cashless payments and financial inclusion identified as government priorities. (Source: Vietnam CSP, draft update).

Cautious optimism, broad opportunities

Growth opportunities for Australia’s fintech companies include:

- Data analytics, big data and artificial intelligence

- Insurtech, wealth management and neobanking

- Risk management and cybersecurity, including regtech, anti-money laundering and fraud prevention solutions.

- Front-end products and services, such as Electronic Know Your Customer (eKYC)/digital identity, consumer and SME lending and products that support the digitalisation of sales and marketing.

- Backend systems, including products that support the digitalisation of databases and processes. Technologies utilised could include blockchain, cloud computing, robotic process automation, among others.

.png)

Strategic considerations

The Vietnamese fintech market presents significant opportunities, but Australian businesses need to be strategic in their approach.

- Navigating Vietnams’ fintech opportunities requires a well-thought out strategy, it also helps to invest time and resources to understand the country, its people and businesses.

- Be prepared for product localisation for the local market.

- Working with a proficient local partner can accelerate your go to market, opening new channels and networks.

Get involved

Follow Asialink Business on LinkedIn for upcoming details on the Vietnam Fintech launch event on 27 October 2021 and training programs in early 2022.